FBS Minimum Deposit in ZAR

Home » Minimum Deposit

FBS Deposit Requirements Overview

FBS provides South African traders with accessible minimum deposit requirements across different account types. Our deposit structure starts from R18 ZAR, equivalent to $1 USD at current exchange rates. The minimum deposit varies based on account type selection and trading objectives. We support multiple payment methods for South African traders, ensuring convenient fund transfers. The deposit system processes transactions securely through verified payment channels with instant processing for most methods.

Account Minimum Deposits:

Account Type | Minimum in ZAR | Minimum in USD |

Cent Account | R18 | $1 |

Micro Account | R90 | $5 |

Standard Account | R1,800 | $100 |

Zero Spread | R9,000 | $500 |

ECN Account | R18,000 | $1,000 |

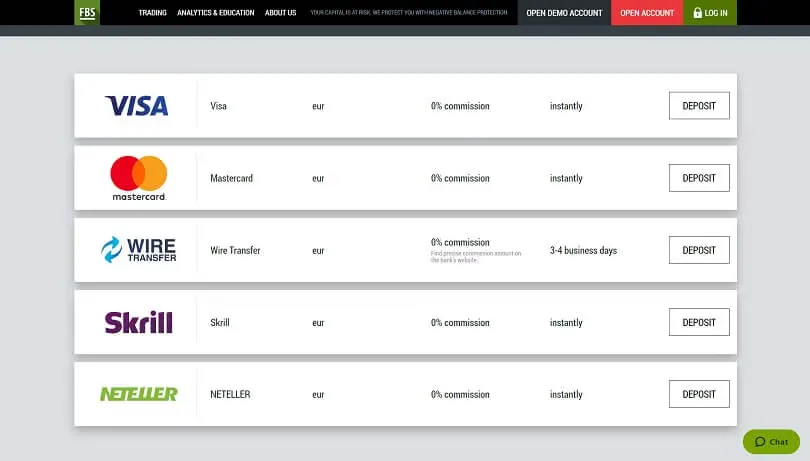

Payment Methods for South African Traders

South African clients access various deposit options through local and international payment systems. Each method maintains specific processing times and security protocols. Electronic payments typically process instantly, while bank transfers may require additional time. Payment method selection affects minimum deposit requirements in some cases. We ensure transparent fee structures across all payment options.

Electronic Payment Processing

Electronic payment systems provide immediate account funding capabilities. The process includes automatic currency conversion when necessary. Security measures protect all electronic transactions. Various e-wallet services support instant deposits. The system confirms successful transactions through multiple channels.

Currency Conversion Procedures

Currency conversion follows real-time exchange rates between ZAR and USD. Our system automatically calculates conversion rates during deposit processes. Exchange rate information updates continuously during trading hours. Conversion fees remain transparent throughout the transaction. The platform displays both ZAR and USD values for clarity.

Standard deposit methods include:

- Local bank transfers

- Credit/debit cards

- Electronic payment systems

- Mobile payment solutions

- Cryptocurrency transfers

These methods ensure flexible deposit options for our South African clients while maintaining security standards.

Account-Specific Deposit Requirements

Each trading account type maintains specific minimum deposit structures. The Cent Account allows entry-level trading with R18 ZAR, enabling new traders to start with minimal investment. Micro Account requirements begin at R90 ZAR, providing additional trading features. Standard Accounts require R1,800 ZAR, offering complete platform functionality. Professional traders accessing ECN Accounts need R18,000 ZAR for institutional-grade conditions.

Deposit Verification Process

Our verification system ensures secure fund processing through multiple steps. Initial deposits require basic account verification completion. Larger deposits may need additional documentation for security. The verification process typically completes within 24 hours. Our support team assists with verification requirements when needed.

Transaction Processing Times

Different payment methods maintain varying processing schedules. Electronic payments typically reflect instantly in trading accounts. Bank transfers process within 2-5 business days for South African banks. Card payments usually complete within 24 hours. Cryptocurrency deposits depend on network confirmation times.

Processing timeframes:

Payment Method | Processing Time | Minimum Amount |

E-wallets | Instant | R90 |

Bank Transfer | 2-5 days | R180 |

Credit Cards | 24 hours | R90 |

Crypto | Variable | R180 |

Deposit Fee Structure

Most deposit methods incur no additional charges from FBS. Payment providers may apply their own fee structures. Currency conversion fees apply at standard market rates. Volume-based fee reductions become available for larger deposits. Transaction fee schedules remain transparent and accessible.

Mobile Deposit Features

Mobile deposits provide convenient account funding options. Our application supports multiple deposit methods through secure channels. The process requires several verification steps for security.

Essential mobile features include:

- Biometric security access

- Real-time transaction tracking

- Multiple payment integration

- Instant notifications

- Transaction history access

- Quick deposit shortcuts

These features ensure smooth mobile deposit operations.

Deposit Security Measures

Security remains our primary focus during deposit processing. Multiple systems work together to protect client funds. Our infrastructure maintains constant monitoring.

Standard security protocols include:

- Multi-factor authentication

- Encryption standards

- Transaction monitoring

- Fraud prevention systems

- Account verification checks

These measures protect every transaction in our system.

Documentation Requirements

Certain deposit amounts trigger specific documentation needs. Proof of payment helps track larger transactions. Identity verification ensures regulatory compliance. Source of funds documentation may apply to substantial deposits. All documents undergo secure processing through encrypted channels.

Deposit Problem Resolution

Our support team addresses deposit issues through established protocols. Transaction tracking systems monitor deposit status. Resolution procedures follow systematic approaches. Support channels remain available during processing hours. Documentation helps expedite problem resolution.

Withdrawal Correlation

Withdrawal methods typically align with deposit channels. Minimum withdrawal amounts differ from deposit requirements. Processing times vary by withdrawal method. Security measures protect withdrawal transactions. Account verification status affects withdrawal processing.

Corporate Account Deposits

Corporate accounts may require higher minimum deposits. Business verification processes apply to company accounts. Multiple payment options support corporate transactions. Dedicated support assists with corporate deposit requirements. Enhanced security measures protect business transactions.

Special Account Considerations

Islamic accounts maintain standard minimum deposit requirements. VIP accounts may require higher initial deposits. Demo accounts require no minimum deposit. Educational accounts follow standard deposit structures. Partnership accounts have separate deposit considerations.

Frequently Asked Questions

Electronic payments typically reflect instantly, while bank transfers may take 2-5 business days. Card payments usually process within 24 hours, depending on your bank and verification status.

Yes, you can deposit in ZAR through local payment methods. The system automatically converts to USD at current exchange rates for trading purposes while maintaining transparency in both currencies.

Deposits below minimum requirements cannot process through our system. The platform automatically notifies users of minimum deposit requirements for selected account types and payment methods.