FBS in South Africa

Home

Introduction to FBS Trading Services

At FBS, we’ve built our reputation since 2009 as a reliable trading services provider in South Africa. Our platform connects over 27 million traders worldwide to financial markets through secure, regulated trading conditions. Operating under FSC (Belize) regulation ensures transparency and security for our South African clients. We process transactions through 200+ payment methods, making trading accessible to everyone. The FBS platform maintains strict security standards while delivering fast execution speeds and competitive trading conditions.

Key Company Information:

Feature | Details |

Establishment | 2009 |

Global Traders | 27M+ |

Regulation | FSC (Belize) |

Trading Assets | 550+ |

Min. Deposit | $5 |

Execution Speed | 0.01 sec |

Support | 24/7 |

Platforms | MT4, MT5, FBS App |

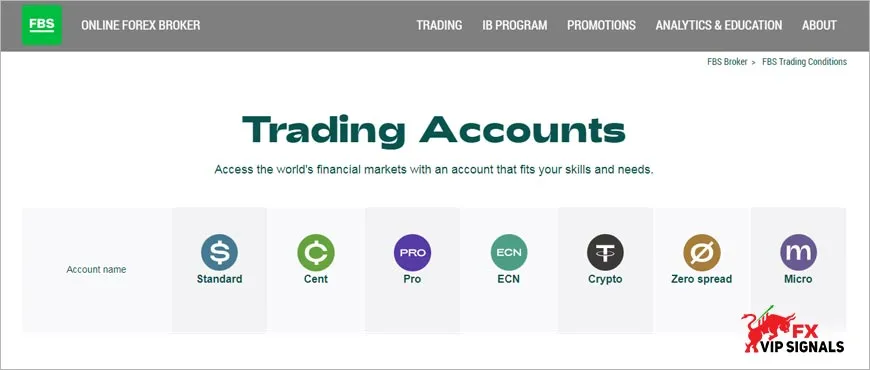

Comprehensive Account Types

We structure our trading accounts to accommodate various trading approaches. The Cent Account starts at $1, enabling new traders to practice with minimal risk exposure. Moving up, our Micro Account requires $5 and provides fixed spreads, while the Standard Account needs $100 and offers floating spreads from 0.5 pips. For advanced traders, the Zero Spread Account requires $500, and the ECN Account starts at $1000. Each account maintains specific features designed to match different trading styles and objectives.

Standard Account Features

The Standard Account represents our most popular trading solution. This account type combines flexible trading conditions with straightforward pricing. Traders access floating spreads starting from 0.5 pips without additional commissions. The leverage extends to 1:3000, allowing for position sizing flexibility. Standard Account holders can open up to 200 positions simultaneously, including pending orders.

Trading Platform Technologies

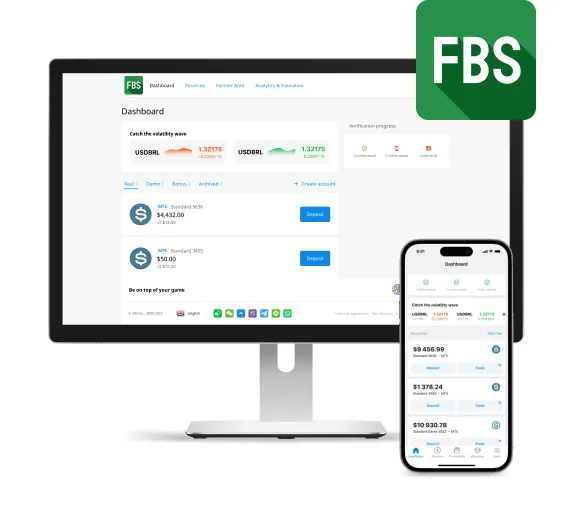

Our trading infrastructure incorporates MetaTrader 4, MetaTrader 5, and the proprietary FBS Trader mobile application. Each platform delivers real-time market data and execution speeds from 0.01 seconds. The technology stack includes advanced charting capabilities with multiple timeframes and technical indicators. We maintain dedicated servers to ensure stable connections and reliable trading conditions throughout market hours.

FBS Trader Mobile Application

The FBS Trader app brings essential trading functions to mobile devices. Users manage their accounts, analyze markets, and execute trades directly from smartphones. The application integrates seamlessly with our trading servers, ensuring consistent performance across devices. Regular updates enhance functionality and security features.

Essential mobile features include:

- Real-time price tracking

- One-click trading execution

- Technical analysis tools

- Account management functions

- Market news integration

- Secure authentication methods

Market Access and Instruments

We provide access to 550+ trading instruments across multiple asset classes. Foreign exchange pairs form the foundation of our offering, with spreads starting from 0.7 pips. Metals trading includes both gold and silver contracts with competitive conditions. The platform supports indices trading on major global markets and various energy products. Our cryptocurrency section features over 100 digital currency pairs. Trading instruments overview:| Asset Class | Number of Instruments | Spread From | Leverage Up To |

| Forex | 50+ | 0.7 pips | 1:3000 |

| Metals | 4 | 1.0 pips | 1:1000 |

| Indices | 11 | 1.0 pips | 1:100 |

| Crypto | 100+ | 1.0 pips | 1:5 |

Security Infrastructure

Our security framework protects client funds and personal information through multiple layers of protection. We implement segregated account structures, keeping client funds separate from operational accounts. SSL encryption secures all data transmission between traders and our servers. The negative balance protection feature prevents accounts from falling below zero. Regular security audits maintain system integrity and identify potential vulnerabilities.Regulatory Compliance

The FSC (Belize) license requires strict adherence to international financial standards. This includes regular reporting, capital adequacy requirements, and operational transparency. Our compliance team monitors trading activities to prevent market manipulation and ensure fair trading conditions. We maintain detailed transaction records and conduct regular internal audits.

Payment Processing Systems

We facilitate financial transactions through multiple secure channels. Electronic payment systems process deposits instantly, while bank transfers typically complete within 2-5 business days. South African traders access local payment methods alongside international options. The withdrawal process follows strict verification protocols to ensure security. Most electronic withdrawals process automatically, reducing waiting times for fund access.

Educational Support Structure

South African traders receive comprehensive educational resources through our platform. Daily market analysis provides actionable insights for trading decisions. Technical analysis covers major currency pairs and other instruments. We conduct regular online sessions focusing on trading strategies and market understanding. The educational content adapts to different experience levels, supporting both new and experienced traders.

Primary educational components include:

- Market analysis reports

- Technical strategy guides

- Economic calendars

- Trading webinars

- Video tutorials

- Trading calculators

Customer Support Framework

Our support team operates continuously, providing assistance in multiple languages. South African traders connect through various channels including live chat, email, and phone support. Technical specialists address platform-related questions and trading inquiries. The support system maintains response times under one minute for most queries. We record all support interactions for quality assurance and improvement purposes.

Frequently Asked Questions

South African traders need to provide a valid ID document, proof of residence not older than 3 months, and complete the account verification process. Additional documents may be required for specific payment methods or account types.

Standard account verification typically completes within 24 hours after submitting all required documents. Some cases may require additional verification steps, extending the process to 48 hours.

Forex trading operates 24/5, from Monday to Friday. Cryptocurrency trading remains available 24/7. Specific instruments like indices and commodities follow their respective market hours, with details available in the trading conditions section of our platform.